Перевод Статьи:

Français

CapexGo is a relatively new yet promising online broker offering access to multiple financial markets, including forex, commodities, stocks, and indices. With an aim to cater to both beginner and professional traders, CapexGo positions itself as a competitive platform for online trading. This review will cover everything you need to know about the CapexGo broker, including its account types, trading platform, fees, and how to prevent scams.

About CapexGo: An Overview

Founded in 2017, CapexGo is a financial services provider that aims to offer seamless trading solutions to its clients. Headquartered in Cyprus, the company is regulated by CySEC (Cyprus Securities and Exchange Commission), ensuring a level of trust and protection for traders. With a well-designed website and intuitive platform, CapexGo provides various investment instruments for retail and institutional clients. However, as with all brokers, it’s essential to do your own due diligence before committing your funds.

What Does CapexGo Offer to Traders?

CapexGo offers a comprehensive range of services, designed to meet the needs of both new and experienced traders. These include:

- Access to global financial markets: Trade currencies, commodities, stocks, indices, and cryptocurrencies.

- Multiple account types: Choose from various account types to suit your trading style and experience level.

- Advanced trading platform: Use CapexGo’s proprietary platform to execute trades efficiently.

- Educational resources: CapexGo provides educational materials and expert advice for traders at all levels.

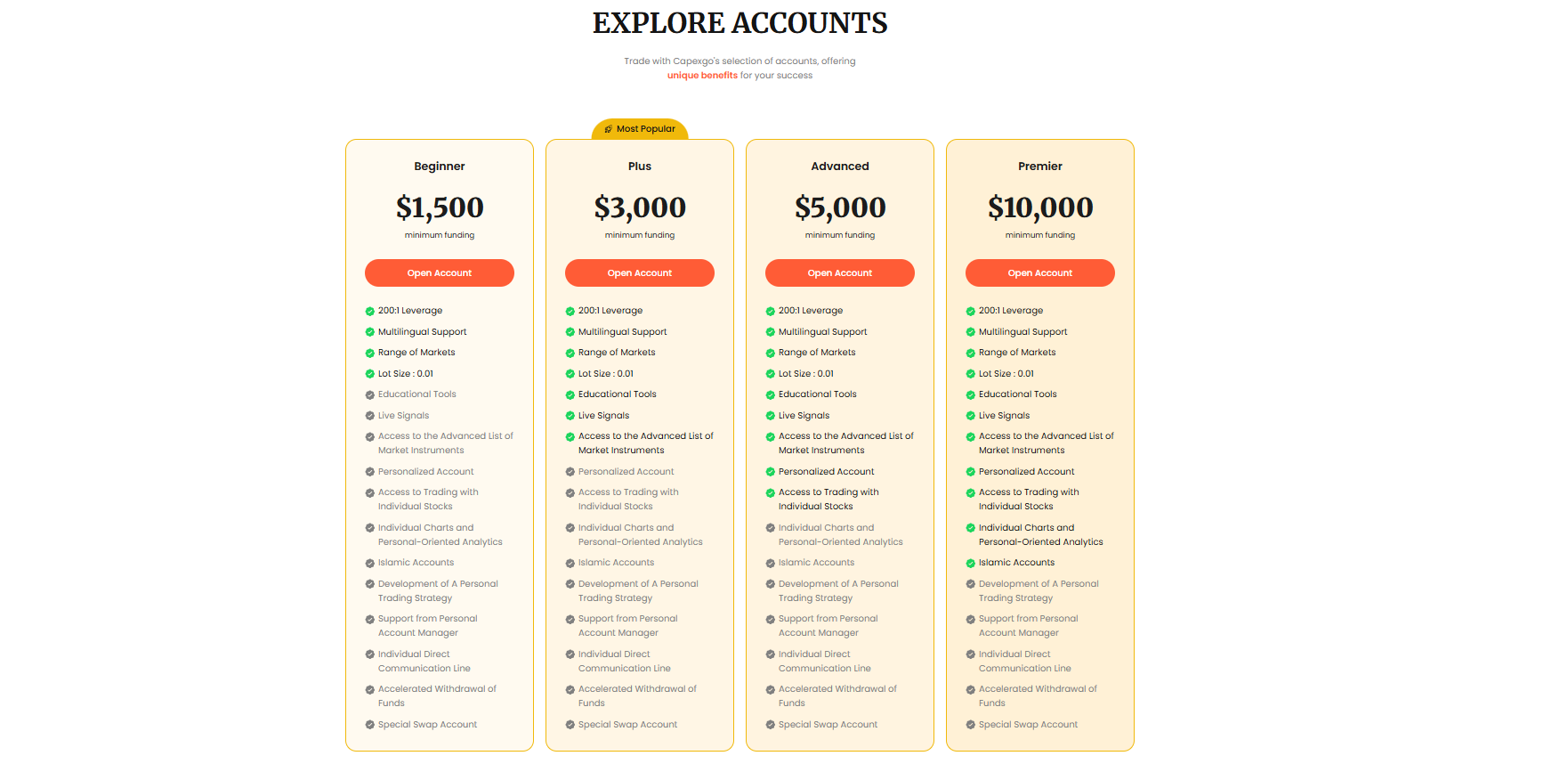

CapexGo Account Types

CapexGo Account Types

CapexGo offers a range of account types designed to meet the needs of both novice and experienced traders. Let’s explore them:

| Account Type | Deposit Requirements | Leverage | Features |

|---|---|---|---|

| Basic | $200 | 1:30 | Access to essential tools and educational content. |

| Gold | $10,000 | 1:50 | Enhanced trading features, personalized support, and exclusive market insights. |

| Platinum | $50,000 | 1:100 | Full access to advanced tools, market analysis, and VIP customer support. |

CapexGo Trading Platform

The CapexGo trading platform is an advanced, easy-to-use platform that provides access to a wide range of financial markets. Some of the key features of the platform include:

- Real-time market data: Get instant updates on market trends and quotes.

- Trading tools and charts: Utilize a range of technical analysis tools, charts, and indicators to refine your strategies.

- Mobile compatibility: Trade on the go with CapexGo’s mobile app, available for both Android and iOS devices.

- Advanced order types: Use limit orders, stop-loss orders, and more for effective risk management.

Moreover, CapexGo’s platform supports automated trading using Expert Advisors (EAs), allowing for 24/7 trading without constant monitoring.

Deposits and Withdrawals at CapexGo

CapexGo offers a variety of deposit and withdrawal methods, ensuring ease and flexibility for its clients. These include:

- Bank transfers

- Visa/Mastercard

- e-wallets such as Skrill, Neteller, and PayPal

The minimum deposit amount varies depending on the account type, with the Basic account requiring a minimum of $200. Withdrawals are processed swiftly, but traders should be aware of any potential fees or minimum withdrawal limits that may apply.

CapexGo Customer Support

Customer support is available through various channels, including:

- Live chat

- Email support

- Phone support

The customer support team at CapexGo is known for its professionalism and responsiveness. However, as with any trading platform, it’s essential to ensure that support is readily available when needed, especially during volatile market conditions.

CapexGo Scam Concerns

While CapexGo is a regulated broker, it’s important to be cautious. As with all online brokers, there are scam concerns that need to be addressed. Traders should be wary of high-pressure sales tactics, promises of unrealistic returns, or any broker that does not provide transparent licensing or company information.

It’s also critical to ensure you are dealing with a licensed and regulated broker like CapexGo to avoid falling victim to scams. Always ensure you check reviews, ratings, and any potential red flags before making a deposit.

Conclusion: Is CapexGo a Reliable Broker?

CapexGo offers a solid trading platform with competitive account types and tools for both beginner and professional traders. While it’s regulated by CySEC and offers a comprehensive range of financial instruments, it’s essential to remain vigilant and verify all information before committing funds. The company provides various educational resources, a responsive customer support team, and an advanced trading platform, making it a reliable option for many traders.

Frequently Asked Questions (FAQ)

Is CapexGo a licensed and regulated broker?

Yes, CapexGo is regulated by CySEC, which is a recognized financial authority in Cyprus. However, always double-check the credentials and verify your broker’s licensing before committing large sums of money.

What is the minimum deposit at CapexGo?

The minimum deposit required to open an account is $200 for the Basic account, $10,000 for the Gold account, and $50,000 for the Platinum account.

Can I trade on CapexGo’s mobile app?

Yes, CapexGo offers a mobile app that supports trading on-the-go for both Android and iOS devices.

Disclaimer: Always conduct thorough research before choosing a broker and never risk more than you can afford to lose.

Capexgo is one of the most convenient platforms I have encountered. It has everything you need for comfortable trading: instant order execution, a wide selection of assets — from currencies and stocks to cryptocurrencies and futures, more than 1,000 instruments. I especially like that you can use the mobile app, web platform or desktop version — it’s convenient to trade anywhere. I was pleased with the analytics, economic calendar and trading signals, which really help in making decisions. Support always responds quickly and politely, and the training materials and webinars allow you to develop and improve your skills quickly. Zero commissions and more than 50 order types make work as convenient and efficient as possible. I recommend CapexGo as a reliable and modern trading platform.