Перевод Статьи:

Русский

The founders of the CapitalCore brokerage project talk about their global plans to launch a unique platform. They tried to develop completely new features that were not seen in other terminals. Thanks to a creative approach, entrepreneurs have formed a brokerage system in which any trader in the world can register. At the same time, the exchange player should take into account that there are many scammers among market intermediaries. Criminal organizations hide under the mask of decent firms, luring their clients out of their last money.

What makes CapitalCore, according to the creators, different from other companies?

The founders of the brokerage project colorfully talk about the unsurpassed quality of service, qualified staff and attentive attitude to each registered client of CapitalCore. The broker describes himself as a promising intermediary who is just starting his professional development.

Given the too young age of the company, the trader may doubt the reality of the presented competitive advantages.

Among the advantages of CapitalCore are:

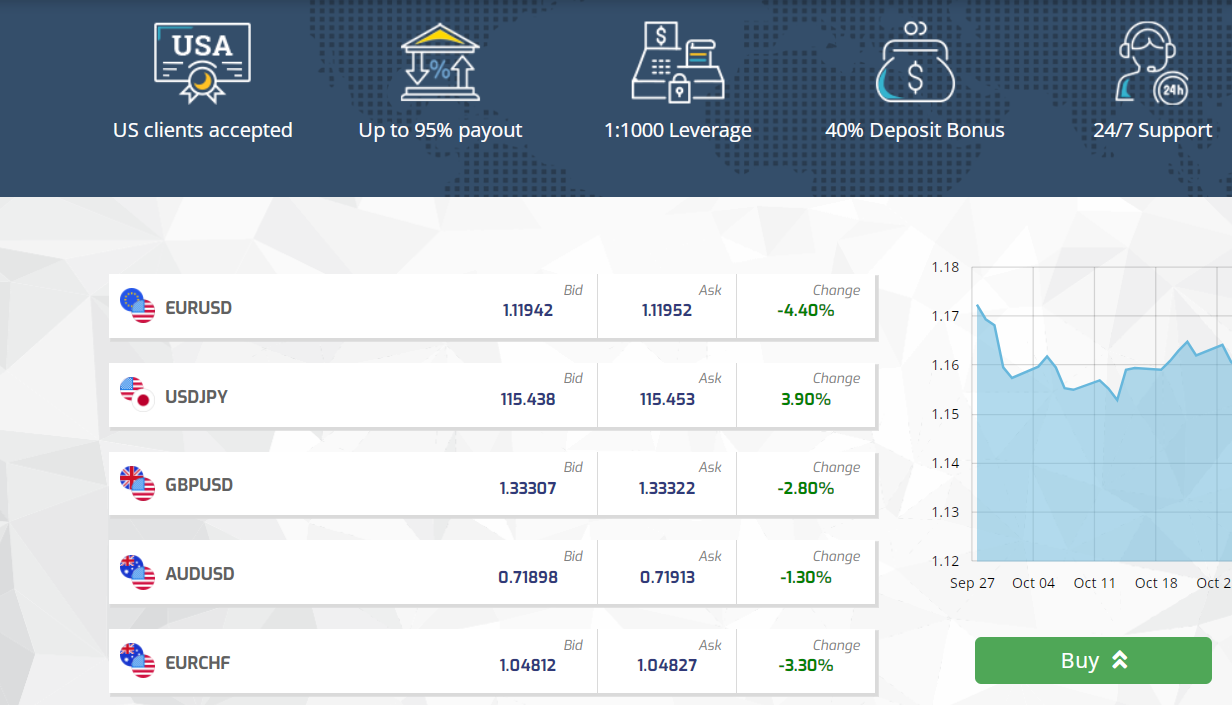

- Round-the-clock trading support that is available even on weekends. The customer can contact the brand representative via online chat.

- The company provides a wide range of cards and digital wallets. A trader can decide through which service to replenish the deposit and withdraw profits.

- Availability of a demo account that allows you to test a new strategy in zero-risk mode.

- Payouts reach 95%. This is a fairly large amount that will allow you to quickly increase the starting capital of an active trader.

- A stock broker caters to both beginners and professionals. It provides extensive educational materials that can help you understand pricing on global exchanges.

As you know, trading is a very risky activity and there are often scammers on the world market. To distinguish criminal fraud from real trade transactions, it is recommended to pay attention to the documents. If brand representatives hide their certificates in every possible way and do not want to disclose information about licenses, then they are engaged in divorce. Such projects are designed for beginners who will not understand the terms of cooperation and will quickly replenish the start-up capital.

Conditions for CapitalCore traders: the company describes the services

The brokerage company invites various exchange traders to cooperate. It will gladly register both a naïve beginner and an advanced trader. There are 4 tariff plans on the capitalcore.com website, each of which provides its own trading conditions.

For a novice market player, it is better to choose the classic plan with a minimum deposit of $250. Before replenishing your account, it is recommended to read in detail the laudatory and negative reviews about the company.

A silver account is suitable for advanced market players. It provides for replenishment from 500 US dollars, leverage up to a ratio of 1:500. The most expensive tariff is activated after a deposit of 2,000 US dollars. The trader gets access to all the features of the CapitalCore trading platform. Reviews on third-party web portals will allow you to make the right choice.

Bottom Line: Is CapitalCore a Hoax?

This brokerage project was launched in 2019. A relatively young intermediary was registered in St. Vincent and the Grenadines. It offers relatively low spreads and quite favorable trading conditions, but what is hidden behind the attractive picture? The company serves residents of all countries, but at the same time it is located in an offshore zone and does not have official licenses. All this is very reminiscent of a scammer who pretends to be a promising brokerage project.

Legal documents play an important role in building a mutually beneficial relationship with a stock broker. If the company is not regulated by anyone, then in case of disputes, the client will not be able to return the money spent. The office is able to manipulate prices, making money on the losses of its clients. Before making a final decision, we recommend that the trader take a close look at the official licenses and certificates that differentiate the scam from the broker.