Перевод Статьи:

Français

Português

Русский

The “Inside Bar” pattern can act as an integral part of an effective Price Action strategy. The productivity of market trading largely depends on the current situation. If you use only a graphical model, it will not bring the desired result, but in combination with other analytical tools, the trader can develop a high-quality strategy.

In today’s article, we will talk about what an inside bar is. A trader will be able to calculate this pattern and determine what trade signal it gives. The graphical formation is very simple and is found on most instruments. At the same time, a stock trader needs to learn how to work with it correctly, understanding the signals received and determining the best moments to place orders.

Features of building an internal bar

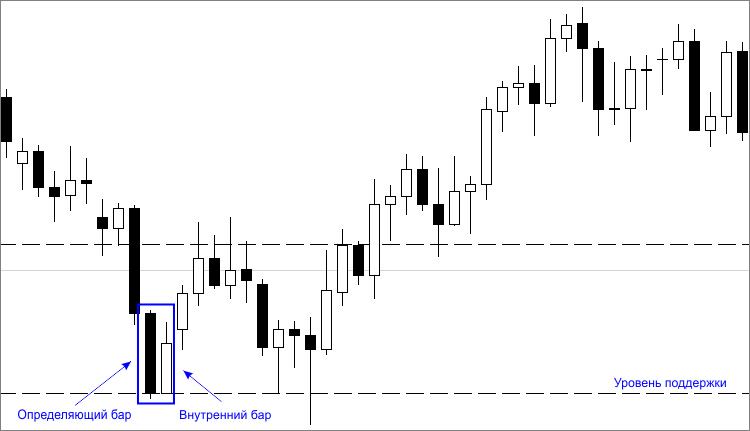

During a strong trend, a pattern may appear on the price chart, which will become a signal and suggest a possible scenario for the development of events. An inside bar is a candlestick that is formed inside the price range of the previous element. The level of volatility in the market decreases, which leads to a reversal of rates. There is a consolidation, which is clearly visible on lower time intervals. The trader will follow the trend, opening a trade at the moment of the breakout.

It is important to note that the previous candle should completely absorb the inside bar. The entire range, including the upper and lower shadows, should fit into the size of the previous chart formation. If this does not happen, then the presence of the pattern is not noted.

An absorbing candle is called a mother candle. If it is bearish, then the next element will be bullish and vice versa. An inside Forex bar can be placed either individually or in groups. In the latter case, the price movement is determined by one of the two formations (the first internal or the previous one).

To fix a signal and follow the rules of the strategy, a novice trader needs to master the important rules of building an inside bar:

- A powerful price impulse that occurs just before the bar itself.

- Consolidation, which is characterized by a period of weak price changes.

On higher time intervals, you should pay attention to the price corridor, which looks like a triangle. At the same time, do not forget that the mother element can break through the level during a strong trend. An inside pin bar will be a signal of an increase in the current price movement.

In some cases, the pattern is placed inside the channel: at the bottom or near the top. If it occurs on the curve of the price chart, then the trader will make an entry with the maximum level of profit. This is the best option for a profitable purchase or sale of an investment asset.

How to Use the Inside Bar Pattern?

When planning trades using the inside bar strategy, a trader should take into account that the chart pattern arises exclusively on strong trends. If the price movement is not powerful or goes flat, it is recommended to find another trading system.

The inner element should not go beyond the boundaries of the outer one, even with shadows. Many stock market players make blunders and then lose their invested capital. As a rule, the Inner Bar formation is not characterized by long shadows. In most cases, the absorbed element is half the size of the absorbing element.

The inside and outside bar chart patterns serve as a confirmation signal. They allow the exchange player to make sure that there is a strong price movement and place appropriate orders.

When applying the model in trading practice, it is necessary to determine the color of both elements. If you plan to exit a trade, then you should not attach importance to the current trends. A True Inner Bar

Price action is associated only with current price movements. This information will be quite enough to organize a productive trading process.

Some stock traders believe that the Inside Bar pattern is able to minimize the existing risks. In part, this is true, but only in the case of trading with the trend. To increase the final earnings, it is recommended to give preference to those strategies that focus on support and resistance levels. Defining channel boundaries will allow you to make clear forecasts and achieve the desired result.

Like any trading system, the tactics of working on the inside bar are not universal. It has its own peculiarities, and therefore it is not suitable for every practicing trader. Before using the strategy, it is recommended to test it on a free account or tariff with a minimum level of risk. In this way, the market trader will reduce potential losses and save himself from ill-considered decisions.